There is also a limit to keep gold in the house! If it is more than that, will the income tax department take it? Know the rules

Gold Limits for House: You may not know but there is a limit for keeping gold in the house as well. Thus, in 1990, this limit was abolished. However, if you have more than a certain amount of gold, you are required to show sufficient documentation or else it will be confiscated.

New Surat : Gold has been given special importance in Indian society for centuries. Even today gold is a good investment option for every Indian as well as a sign of wealth. Indian women's love for gold jewelery is no secret. Many people may be asking here that there is a rule that gold cannot be kept more than a limit in the house? So the straight and simple answer is - No, the government has not set any limit on keeping gold in the house

This question is currently very much in the church as incidents of raids by the Income Tax Department came to light in many places. In the meantime, the Income Tax Department had seized everything including the jewelery found in the house. In many cases the ornaments worn by the women were also confiscated. Because of which, the situation of tension between the tax payers and the tax department often arose.

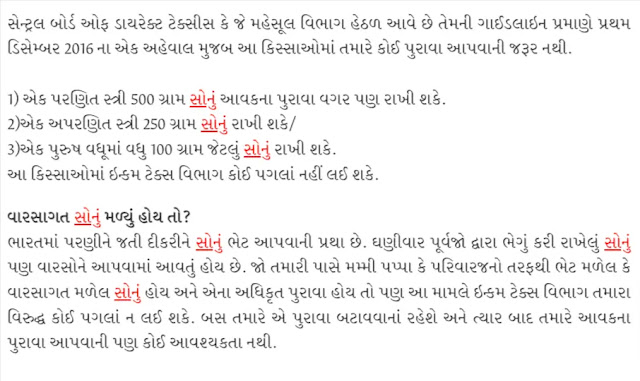

Central Board of Direct Taxes (CBDT) issued a circular to solve this problem. The circular said that gold would not be seized up to a limit in any raid. According to tax and investment expert Balwant Jain, if you have gold within this limit, it cannot be confiscated even if it is not documented, while if you have gold above this limit, you must have proper documentation. If everything is fine then there will be no seizure.

The gold holding limit is as follows – A married woman can have 500 grams of gold, an unmarried woman can have 250 grams of gold and a man can have 100 grams of gold. Even if you don't have that much gold documents during the raid, it can't be confiscated. Notably, this is only about the charms. There is no mention of gold biscuits and bricks in the CBDT circular.

Limits set earlier: According to Balwant Jain, the Gold Control Act of 1968 imposed a limit on keeping gold at home but it was removed in 1990. In 1994, the CBDT issued a circular directing its officials not to seize gold jewelery up to the above limit.

This step was taken to reduce the tension between taxpayers and income tax officials. However, when the tax payers are asked to appear before the department during the investigation, they have to show the correct documents related to such gold.

What is the rule about inherited gold? -

Even if a person has inherited gold jewelery from grandparents or ancestors, the same rule will apply. They have to show those gold documents. They have to provide proof that the jewelery belongs to their ancestors.

If the documents are correct then they will not be confiscated. If there are no documents then the Income Tax officials can take that gold with them. You can get them released later with proper documents.

(Disclaimer: The legal advice and information provided here is for basic and general information purposes only. Before taking any decision you should consult a legal expert and your lawyer.)